“RM0.50 service charge.”

“RM1 processing fee.”

“RM3 convenience charge.”

You’ve seen them everywhere, on Touch ’n Go reloads, bank transfers, parking apps, and even when you buy movie tickets online.

They look harmless.

But here’s the truth: these small charges are quietly draining billions of ringgit from Malaysians every year, one tap, one top-up, one “OK” button at a time.

1. The Death by a Thousand Fees

It starts small.

RM0.50 here for a reload.

RM1 for a transfer.

RM3 for a “convenience” you never asked for.

In the past, these were exceptions. Today, they’re everywhere from your Touch ’n Go app to your electricity bill payment portal.

We don’t notice it because the number is too small to feel. But add it up across the country, and the total becomes staggering.

2. The 50 Sen Reload That Broke the Internet

When Touch ’n Go announced a RM0.50 reload fee at physical counters, Malaysians exploded.

The anger wasn’t about fifty sen, it was about the principle.

You already paid for the card.

You’re already using your own money.

Now, you’re charged again to access it.

That’s not digitalisation.

That’s monetising loyalty.

And the worst part?

Most people still shrug and pay it because “it’s only 50 sen.”

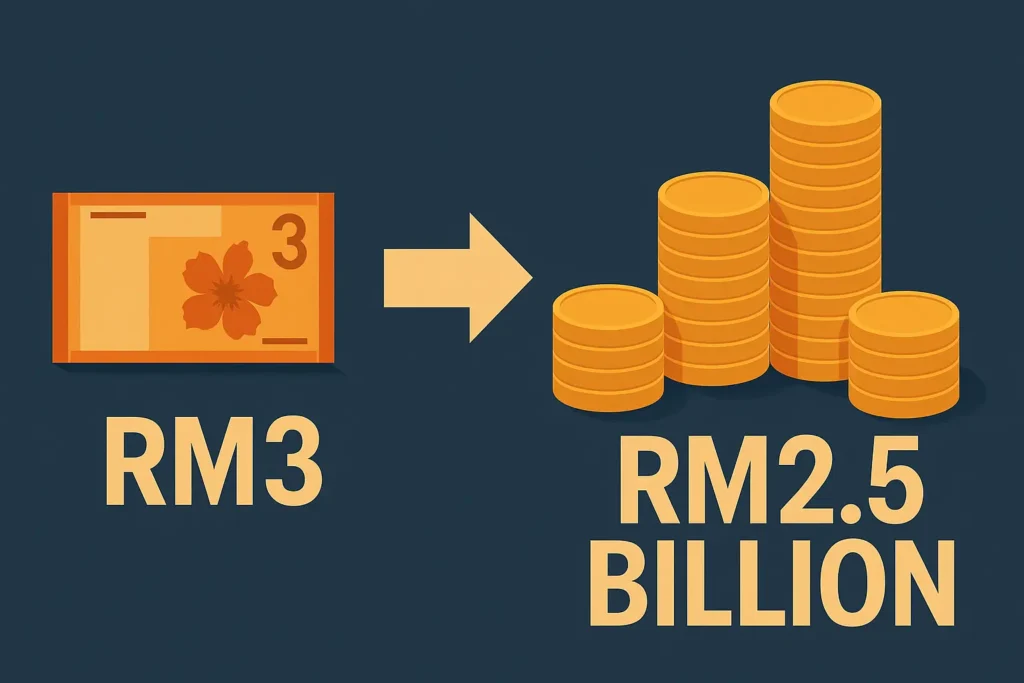

3. How RM3 Becomes RM2.5 Billion

Let’s look at the math.

There are around 16 million working Malaysians.

If each person loses RM3 per week through small digital fees from reloads, transfers, parking apps, and online “service charges” that’s:

RM3 × 52 weeks × 16,000,000 = RM2.5 billion per year.

That’s enough to fund:

- 10 new public hospitals, or

- 200,000 student laptops, or

- a nationwide cost-of-living relief programme.

All gone not from corruption or taxes but from “processing fees.”

4. The Psychology Behind “It’s Just RM3”

There’s a reason you don’t feel it.

Psychologists call it “micro pain bypass.”

Your brain is wired to ignore small losses even if they happen 100 times.

You’ll think twice before losing RM300.

But you’ll lose RM3 a hundred times without blinking.

Corporations know this.

They don’t need to overcharge you once.

They just need you to stop caring about small numbers.

5. Who Really Profits From It

Every RM3 you lose flows upward to banks, fintech apps, and payment gateways.

- Banks charge RM1 per interbank transfer after your free quota.

- Apps take “processing” fees for bill payments.

- Super-apps skim commissions from every Grab ride or e-wallet payment.

- Parking apps add RM0.50 – RM1 “handling fees” per session.

Each platform earns a little.

Together, they build billion-ringgit empires powered entirely by the small leaks in your wallet.

6. The Digitalisation Lie

Malaysia loves to brag about being “cashless.” But behind every tap, scan, and QR code, someone is quietly charging you for the privilege. We’re told these fees are for “system maintenance” or “security upgrades.” Yet every year, the fees go up while the service stays exactly the same.

Here’s the irony: Digital systems are supposed to get cheaper with scale, not more expensive.

Once the servers, gateways, and apps are built, the cost per transaction actually drops.

So why are Malaysians still paying more?

Because digitalisation here isn’t about efficiency, it’s about monetisation. What was meant to make life simpler has turned every payment into a business model. And every “cashless” tap is now just a quieter way to take your money.

7. How to Stop Paying the “Convenience Tax”

You can’t eliminate every fee, but you can outsmart most of them.

1. Get the new Touch ’n Go NFC card: reload it instantly from your phone and skip the RM0.50 kiosk fee, no waiting, no hidden charge.

2. Use bank apps with zero transfer fees: Maybank MAE, UOB One, or BigPay.

3. Batch your payments: fewer transactions, fewer “service” charges.

4. Track your leaks: apps like Money Lover or Spendee reveal how small fees quietly eat your budget.

5. Reward yourself back: use credit cards with cashback or e-wallet promos that offset these micro-costs.

Small savings multiply the same way small losses do.

8. Final Thoughts

You don’t go broke from one bad decision.

You go broke from a hundred small ones you never question.

That RM3 you ignore?

Multiply it by millions of Malaysians, and you’ll see a quiet billion-ringgit economy built entirely from your indifference.

So the next time you see

“RM0.50 service fee”

or

“RM3 convenience charge,”

ask yourself: Convenient for who?

Because convenience isn’t free, it’s just a new kind of tax.

And Malaysians have been paying it for far too long.

If you’re serious about taking control of your money, start here:

How to Stop Being Broke in Malaysia: 9 Brutal Truths You’re Avoiding

and

The Malaysian Money Dilemma: Pay Down Loans or Build Wealth First?