If you think alternative investing means crypto staking or fractional property apps, think again.

Across Malaysia, people are quietly making money flipping the most unexpected things such as office chairs, coffee machines, monitors, salon beds, café equipment, even unopened warehouse stock all bought from liquidation and insolvency auctions for a fraction of their value.

It sounds unbelievable until you see someone buy RM1,500 worth of office chairs for RM300… and then sell them for RM120 each on Facebook Marketplace.

This is the world of auction flipping, a very Malaysian blend of chaos, opportunity, and sharp timing and one of the most underrated investments to exist in 2025.

1. What Is Auction Flipping? (The Malaysian Version)

If you’ve ever seen an office shut down, a café close suddenly, or a warehouse clearance notice, that’s where auction flipping begins.

When businesses collapse or relocate, all their assets, chairs, shelves, printers, ovens, tools go straight to auction because liquidators and banks don’t want to store anything.

Their goal is to clear everything fast, not maximise price.

This creates a rare window where good, usable assets get sold way below their normal market value and everyday Malaysians buy them, clean them, and resell them online for what people are already willing to pay.

How It Works

- A company closes or gets liquidated.

- Their items are pushed to a licensed auctioneer.

- You bid on lots starting from RM50–RM300.

- You pick up the items.

- You resell them at standard second-hand prices.

- Profit is the gap between liquidation price and normal market value.

There’s no guessing, no “maybe the price will appreciate”. You’re simply buying undervalued assets and selling them where demand already exists.

Why It Exists

• Liquidators follow deadlines set by courts.

• Banks don’t want storage costs.

• Government agencies need to clear seized items.

• Nobody wants to move bulky equipment.

• Malaysians constantly buy second-hand items.

This mismatch creates margins, big ones.

2. What You Can Buy (And Actually Sell Fast)

The fastest-selling auction items in Malaysia right now:

• Office chairs, desks, and monitors

• Café equipment (espresso machines, grinders, ovens)

• Industrial shelving and stainless-steel racks

• Retail fixtures and unopened stock

• Tools and hardware

• Salon beds, hairdryers, spa equipment

• Home appliances (microwaves, fridges, fans)

• Warehouse inventory (cleaning products, household items)

Anything functional, common, and easy to move sells quickly.

3. What You Can Earn (Realistic 2025 Numbers)

Average returns look surprisingly strong because liquidation prices are low and second-hand demand in Malaysia is high.

Typical Profits (Beginner Level)

• Office chair lot: RM300 → RM1,000 (RM700 profit)

• Monitor lot: RM250 → RM800–RM1,000

• Industrial shelving: RM150 → RM500–RM900

• Café machine: RM200 → RM800–RM1,200

Bigger Flips

• Bakery oven: RM500 → RM2,000–RM4,000

• Hair salon bed set: RM400 → RM1,200–RM1,800

Monthly Potential

RM600–RM2,000/month (casual beginner)

RM2,000–RM8,000/month (consistent flippers)

Turnover is fast because Malaysians love deals, especially on practical items.

4. Where To Find Legit Auctions

These are fully legal, regulated sources:

• Licensed auction houses (KL, Penang, JB)

• Insolvency Department auctions

• Court-appointed receiver auctions

• Bank asset recovery sales

• Majlis & Customs seized-goods auctions

• Factory liquidation sales

All are open to the public. No insider contacts needed.

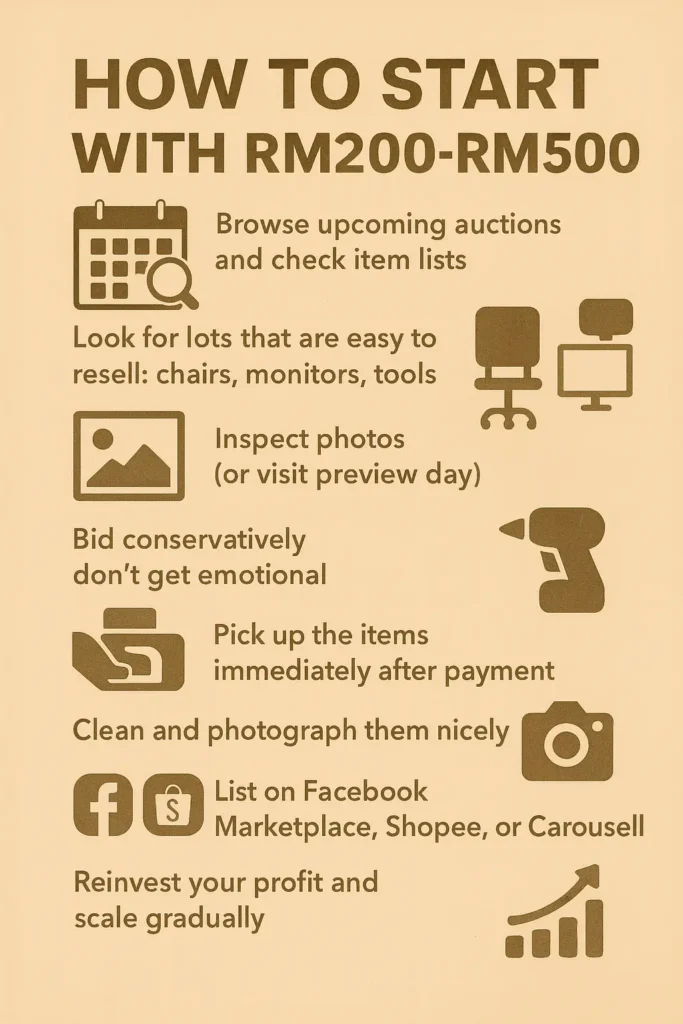

5. How To Start With RM200-RM500

- Browse upcoming auctions and check item lists.

- Look for lots that are easy to resell: chairs, monitors, tools.

- Inspect photos (or visit preview day).

- Bid conservatively don’t get emotional.

- Pick up the items immediately after payment.

- Clean and photograph them nicely.

- List on Facebook Marketplace, Shopee, or Carousell.

- Reinvest your profit and scale gradually.

You don’t need a shop or warehouse. Many flippers start with a bedroom or car boot.

6. Pro Tips (To Avoid Junk or Overpaying)

• Avoid items that are too niche or bulky.

• Stick to categories you understand.

• Check for missing cables or parts.

• Don’t buy “mixed lots” unless you inspect them.

• Bring tools for dismantling during pickup.

• Transport cost matters so factor it in.

• Never bid against emotional buyers; walk away.

7. Earnings Reality Check (2025)

| Item | Buy Price | Resell Price | Profit |

|---|---|---|---|

| Chair lot | RM300 | RM1,000 | RM700 |

| Monitor lot | RM250 | RM850 | RM600 |

| Industrial rack | RM150 | RM600 | RM450 |

| Coffee machine | RM200 | RM1,000 | RM800 |

| Salon bed | RM400 | RM1,300 | RM900 |

Returns like these are common because liquidation undervaluation is extreme.

8. Tax & Legal Basics

Income from flipping counts as business income if consistent.

LHDN requires declaration if your total annual income exceeds RM34,000- RM37,000 after EPF.

Keep simple records, screenshots, and payment proofs.

Auction purchases are legally recognised expenses.

Final Thoughts: Real Assets, Real Demand

Auction flipping works because it solves a very Malaysian problem: businesses collapse fast, and people always need affordable second-hand items. It’s the kind of investment that doesn’t require luck, timing, or technical knowledge, just awareness, patience, and a small amount of starting capital.

In a world where investing feels increasingly digital, it’s refreshing to find something grounded, real, and surprisingly profitable. And for Malaysians willing to try something unconventional, auction flipping might be the smartest investment nobody talks about.

Keep Reading

If you enjoyed this guide, you’ll love these other RinggitWise deep dives:

- How to Become Rich in Malaysia (2025) – A practical, step-by-step guide to building long-term wealth

https://ringgitwise.my/how-to-become-rich-in-malaysia-2025-a-step-by-step-guide-to-building-wealth/ - How to Start a Small Business in Malaysia (2025 Guide) – From idea to launch, everything beginners need to know

https://ringgitwise.my/how-to-start-a-small-business-in-malaysia-2025-guide/