Most Malaysians are taught to fear debt, to see loans, credit cards, and financing as traps to escape from. But for the rich, debt isn’t a burden; it’s a financial tool. The difference between those who stay stuck and those who move ahead isn’t how much they earn, but how they use what they borrow.

Wealthy Malaysians understand something most people don’t: you can’t save your way to wealth anymore. Inflation eats too much, salaries rise too slowly, and opportunities move too fast. But you can borrow your way to wealth, if you borrow for the right reasons.

1. What “Smart Debt” Really Means

Not all debt is bad. In fact, some of the wealthiest Malaysians became rich because they borrowed. The difference is in the purpose.

Smart debt is borrowing money to create more money. It could be financing a property that generates rental income, using a business loan to expand operations, or even taking a zero-interest instalment to buy equipment that earns you income. Bad debt, on the other hand, funds consumption, things that lose value the moment you pay for them, such as cars, gadgets, or vacations.

The goal is simple: every ringgit you borrow should help you earn more than it costs to repay.

2. How the Rich Use Debt as a Tool

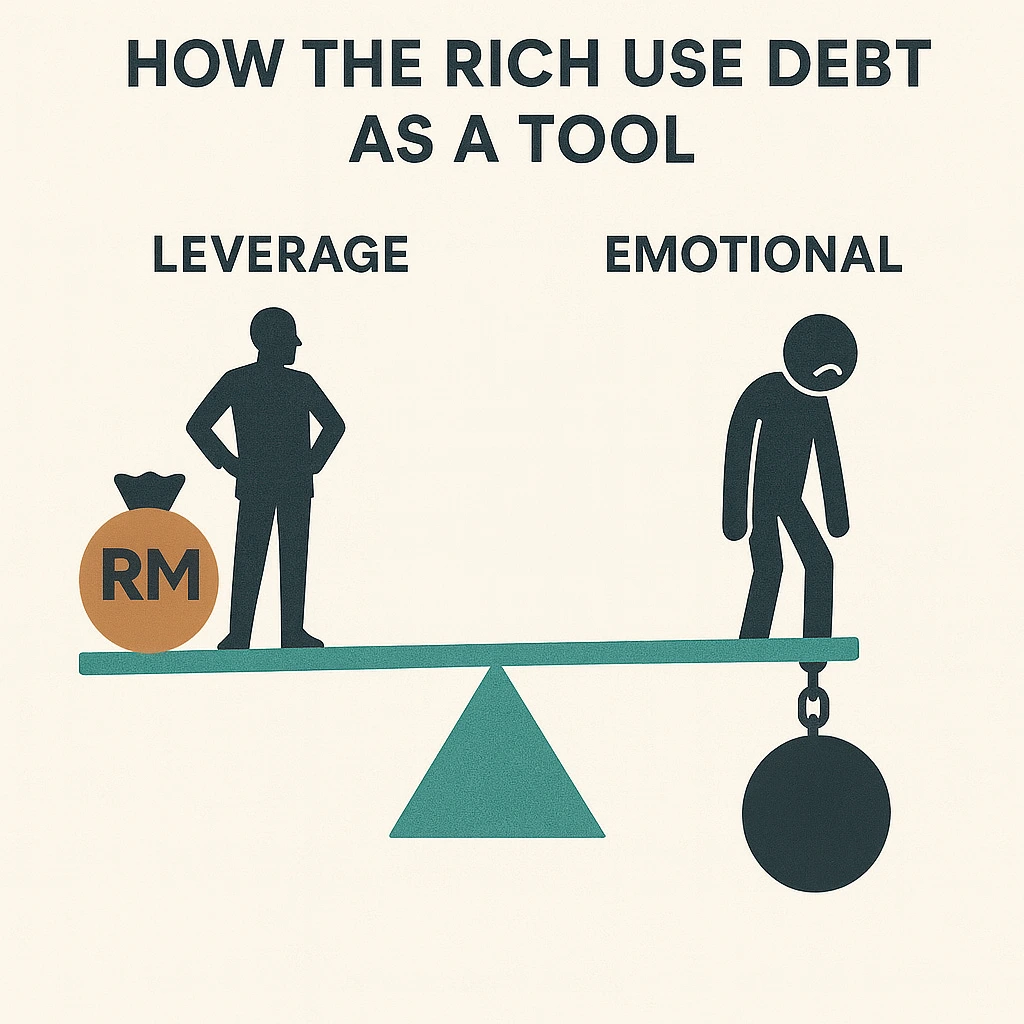

Rich Malaysians treat money like leverage, not savings. They borrow at low interest (often 3% to 5%) and channel it into higher-return assets such as dividend-paying stocks, rental properties, or business expansion. That difference between what they earn and what they pay in interest is pure profit, repeated over and over.

In contrast, most people see debt emotionally rather than strategically. We borrow to feel secure, not to grow. The wealthy see debt as a calculated partnership between time, money, and opportunity, a way to move faster without risking their own capital.

Of course, don’t compare yourself to someone born into wealth, that’s like entering a marathon when they started halfway and you’re still looking for parking.

3. The Middle-Class Debt Trap

Middle-class Malaysians borrow “responsibly” for houses, cars, education, or weddings, but responsibly doesn’t always mean strategically. These loans don’t generate cashflow; they lock you into decades of repayment.

And here’s the painful part: what used to be achievable for our parents now costs 2–3× more relative to income. A terrace house in the 1990s was around RM90k when salaries averaged RM2k. Today, a similar home costs RM600k+ while income only rose to RM7k- RM8k. Cars, weddings, and even education followed the same pattern, prices shot up, salaries crawled.

It looks stable, but it’s really a treadmill. You’re not going broke, but you’re not getting ahead either. The system rewards predictability, not prosperity.

4. Good Debt vs Bad Debt in Malaysia

Here’s a simple rule: if your loan pays for itself, it’s good. If it drains your cash, it’s bad.

| Type | Example | Outcome |

|---|---|---|

| Good Debt | Rental property, business expansion, education that increases income | Generates profit or cashflow |

| Neutral Debt | Own-home mortgage, car loan for work purposes | Stable but no profit |

| Bad Debt | Personal loans, credit cards, weddings, lifestyle purchases | Consumes wealth, no return |

Before signing any loan agreement, ask yourself one question: “Will this debt make me richer, poorer, or just look richer?”

5. The Power of OPM: Other People’s Money

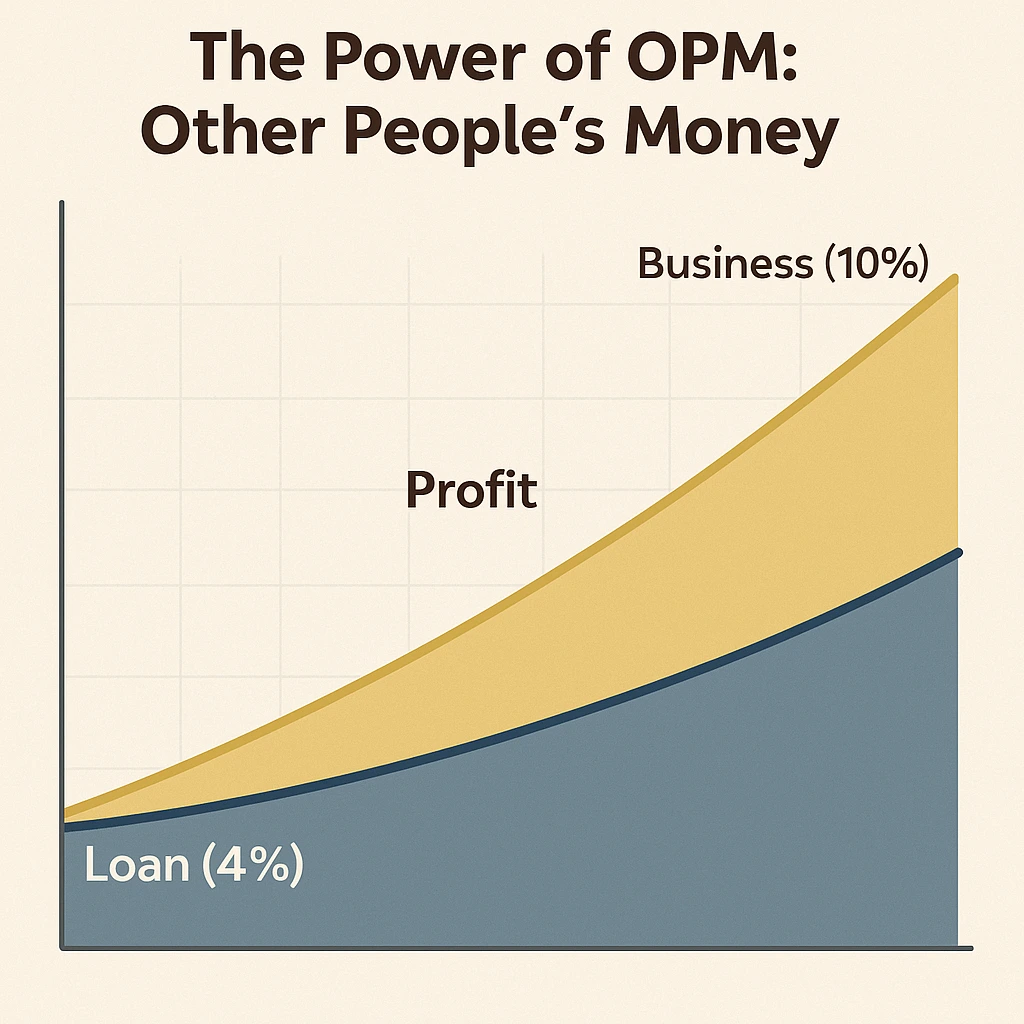

The richest people in Malaysia, property developers, business owners, and investors rarely use their own money. They use OPM: Other People’s Money.

Banks, investors, customers, and even suppliers help finance their ventures. They borrow at 4% and earn 10%, repeating the cycle at scale. It’s the same principle that runs modern economies, leverage, not labour, creates exponential growth.

Ordinary Malaysians fear loans because they associate them with risk. The rich see loans as access, a bridge between opportunity and timing.

6. How to Borrow Like the Rich

Borrowing smartly doesn’t mean taking on more loans. It means using credit strategically and mathematically, not emotionally.

- Borrow only when it produces cashflow. If it doesn’t earn or grow value, it’s a liability.

- Track your interest rates. The rich don’t just look at profits, they study cost of capital. Borrow at 3%, earn at 8%.

- Keep cash liquid. Never lock up all your capital. Having reserves lets you seize new opportunities or refinance if rates drop.

- Avoid ego purchases. If you’re borrowing to impress, you’re already losing.

- Treat banks as business partners. Compare, negotiate, and restructure loans. Don’t just accept what’s offered, every percentage point matters.

Smart borrowing isn’t about being risky. It’s about being intentional.

7. Final Thoughts

The rich don’t play a different game; they simply understand the rules better. While most Malaysians borrow to maintain their lifestyle, the wealthy borrow to expand their wealth. They make debt work for them, not against them.

In the end, financial success isn’t about working harder or saving more, it’s about understanding direction. Borrowing money isn’t the problem; borrowing without a plan is. When you control your debt, you control your future.

Ready to make your debt work for you instead of against you?

Find smarter, lower-interest loans that actually help you grow wealth:

Compare Personal Loans in Malaysia

If you want to take the next step in mastering your money, read these next:

The Malaysian Money Dilemma: Pay Down Loans or Build Wealth First?

How to Stop Being Broke in Malaysia: 9 Brutal Truths You’re Avoiding

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always consult a licensed financial advisor before making major money decisions.