Can the average Malaysian become rich? Definitely, but it demands more than just hope. You need a well-structured plan, disciplined execution, and smart financial strategies. While low wages, inflation, and overspending are real challenges, they can be overcome with clarity and consistency.

This comprehensive 2025 guide combines practical insights and verified data to help Malaysians from all walks of life increase their income, reduce financial waste, and strategically invest for long-term success. Whether you’re a fresh graduate, mid-career professional, or entrepreneur, this guide equips you with a blueprint to build real, lasting wealth in Malaysia.

1. Master the Basics: Fix Your Finances First

Track Your Spending and Build a Solid Budget

Start with the 50/30/20 budgeting rule:

- 50% for Needs: Housing, food, utilities

- 30% for Wants: Lifestyle and leisure

- 20% for Savings and Investments

Use budget-tracking apps like Money Lover, MAE by Maybank, or BigPay to analyze where your money goes. Eliminate wasteful spending and channel those funds toward your future.

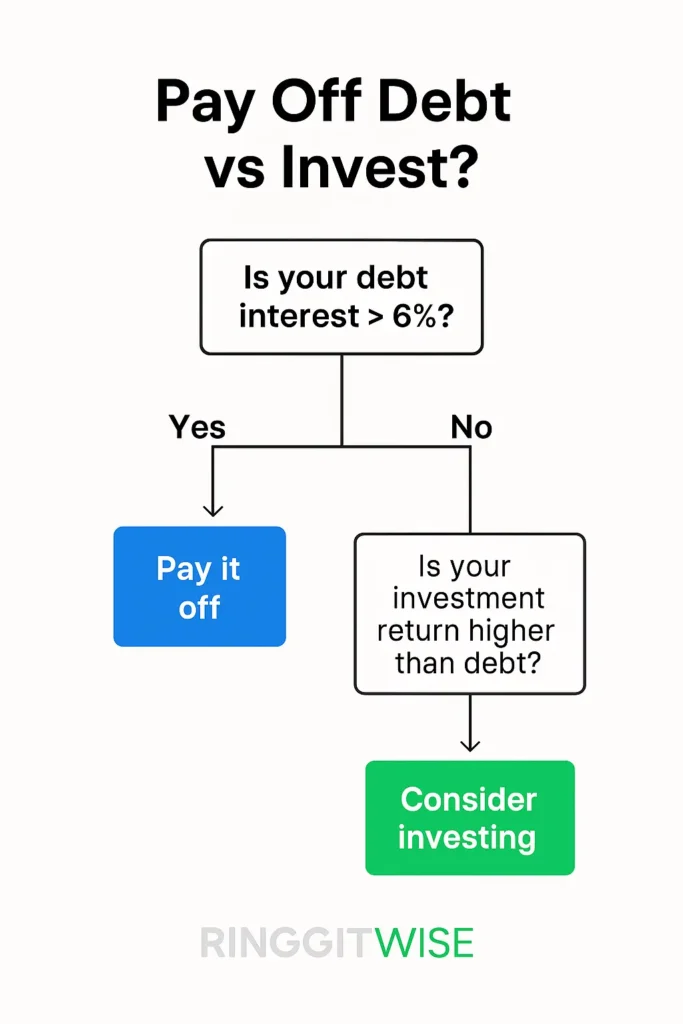

Eliminate Debt and Avoid Lifestyle Inflation

Pay down high-interest debt such as credit cards or personal loans. Consider debt consolidation tools like balance transfer cards to manage repayments. Resist the urge to upgrade your lifestyle with every raise, instead, increase your savings rate.

Be careful with Buy Now Pay Later (BNPL) schemes, while they seem interest-free, they often encourage overspending and can quietly stack up your liabilities. Klarna, Atome, or Grab PayLater may split payments, but the full amount still comes from your pocket.

Avoid the trap of upgrading your lifestyle every time your salary increases. Instead, channel that extra income into savings or investments.

Becoming debt-free gives you financial freedom to grow your wealth.

2. Increase Your Income: Build Multiple Revenue Streams

Negotiate a Higher Salary

Benchmark your industry’s salary with tools like JobStreet or Glassdoor. Upskill in high-demand areas such as tech, design, or digital marketing. Present measurable achievements when asking for a raise.

Start High-Earning Side Hustles

Lucrative side gigs in Malaysia include:

- Freelancing: Writing, design, video editing, web development

- E-commerce: Print-on-demand, dropshipping, digital downloads

- Content Creation: Monetize via YouTube, TikTok, or blogs

- Affiliate Marketing: Promote platforms like Shopee, Lazada, or investment tools

- Online Coaching: Language, fitness, finance, or soft skills

Acquire High-Income Skills

Take affordable courses on Udemy, Coursera, or LinkedIn Learning in areas like:

- Programming and web development

- Artificial Intelligence and machine learning

- Digital marketing and SEO

- Stock investing and personal finance

Skills are modern currency, mastering in-demand ones will accelerate your earning potential.

3. Invest Wisely: Make Your Money Work for You

Best Investment Options in Malaysia (2025)

- Fixed Deposits & ASB: Low risk, returns up to 5.5% p.a. (promos even higher)

- Unit Trusts & ETFs: Invest in diversified portfolios via Bursa Malaysia or U.S. markets

- Stocks: Local or global equities for long-term gains

- REITs: Property income without managing real estate

- Robo-Advisors: Hands-free investing via StashAway, Wahed, or MyTheo

Wealth-Building Investment Habits

- Start investing early, even RM100/month compounds over time

- Automate monthly contributions

- Apply Dollar-Cost Averaging (DCA) to smooth market volatility

- Reinvest dividends and returns for compounding growth

4. Build Passive Income: Create Money While You Sleep

Top Passive Income Strategies in Malaysia

- Dividend Stocks: Invest in companies with regular payouts (e.g., Maybank, Public Bank)

- REITs: Earn rental income from retail, office, and industrial property portfolios

- Digital Products: Sell e-books, Notion templates, or online courses

- YouTube Monetization: Combine ads, affiliate links, and sponsors

- Affiliate Marketing: Promote financial tools or ecommerce platforms

Passive income gives you freedom, security, and a pathway to early retirement.

5. Protect Your Wealth: Avoid Setbacks That Destroy Riches

Stay Ahead of Scams

Malaysia lost RM1.57 billion to scams in 2024. Common tactics include fake investment schemes and impersonation fraud.

- Verify with Bank Negara Malaysia or check the National Scam Response Centre (NSRC)

- Be suspicious of promises with “guaranteed” returns or urgent pressure to invest

Build an Emergency Fund

Keep at least 6 months’ worth of expenses in a high-interest savings account. This safety net covers job loss, medical emergencies, or family crises.

Insure What Matters

- Health Insurance: Cover hospital stays and treatments

- Life Insurance: Protect your loved ones financially

- Critical Illness: Get coverage for major diseases

Security is not optional, it’s part of smart wealth planning.

6. Think Long-Term: Plan for a Richer Future

Develop a Millionaire Mindset

- Be consistent and patient, riches are built over time, not overnight

- Stay curious, read books, attend finance workshops, follow money-savvy mentors

- Surround yourself with people who support financial growth

Plan for Generational Wealth

- Draft a Will and setup an estate plan

- Teach kids financial basics and investing early

- Choose long-term assets like real estate or index funds that hold or grow in value

True wealth isn’t just what you earn, it’s what you leave behind.

Join thousands of Malaysians receiving expert advice on saving, investing, and financial planning every week.

Final Thoughts: Can You Really Become Rich in Malaysia?

Yes, you can, but only if you’re willing to act with purpose. Here’s what the roadmap looks like:

- Increase your income with skills and side businesses

- Save aggressively and invest intelligently

- Avoid financial traps and plan for the unexpected

Wealth isn’t about luck or timing, it’s about daily, disciplined action. Start where you are, with what you have. The best time to begin was yesterday. The next best time is now.

You’ve just learned how to grow your income, invest smart, and protect your future. But here’s the truth: most Malaysians still retire broke, not because they didn’t try, but because they didn’t plan early enough.

Don’t make the same mistake.

Check out this article to get your FREE Checklist

See exactly what you should be doing in your 20s, 30s, or 40s to build long-term financial freedom in Malaysia.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always consult a licensed financial advisor before making major money decisions.

8 thoughts on “How to Become Rich in Malaysia (2025): A Step-by-Step Guide to Building Wealth”