Every March, it’s the same story.

Malaysians rushing to collect receipts for laptops, gym memberships, dental visits, and insurance just to “claim everything” before the e-Filing deadline.

But here’s the truth nobody tells you:

If you don’t earn enough to be taxed, all those receipts don’t save you a single sen.

Tax reliefs don’t give you free money. They only reduce the amount of tax you owe.

If your tax payable is zero, then no matter how many receipts you keep, your refund will still be zero.

Only 12% of Malaysians Actually Pay Income Tax

According to LHDN data, only about twelve percent of Malaysians contribute to income tax.

That means nearly nine out of ten working adults pay nothing at all, not because they’re dodging it, but because they don’t earn enough to be taxable.

Malaysia’s effective tax threshold starts around RM36,000 to RM40,000 per year, roughly RM3,000 a month after EPF deductions.

If you earn below that, you’re automatically exempt.

So when people proudly say they’re claiming RM9,000 in lifestyle reliefs, it’s only meaningful if their income already crosses that threshold.

Reliefs Don’t Reward You. They Just Reduce Your Bill

Most people confuse “relief” with “rebate”.

A rebate gives you money back.

A relief only reduces your chargeable income, the figure used to calculate your tax.

| Person | Annual Income | Tax Before Relief | Reliefs Claimed | Tax After Relief | Real Savings |

|---|---|---|---|---|---|

| A (RM36k/year) | RM36,000 | RM0 | RM9,000 | RM0 | RM0 |

| B (RM80k/year) | RM80,000 | RM3,700 | RM12,000 | RM2,200 | RM1,500 saved |

| C (RM200k/year) | RM200,000 | RM20,000 | RM12,000 | RM18,500 | RM1,500 saved |

Person A earns too little; reliefs change nothing.

Person C earns a lot; the savings are small compared to their total tax.

Person B (the M40) feels the difference most clearly. A few thousand ringgit in claims can mean a real RM1,500 back in their pocket.

That’s why reliefs aren’t for the rich or poor. They’re built for the middle class.

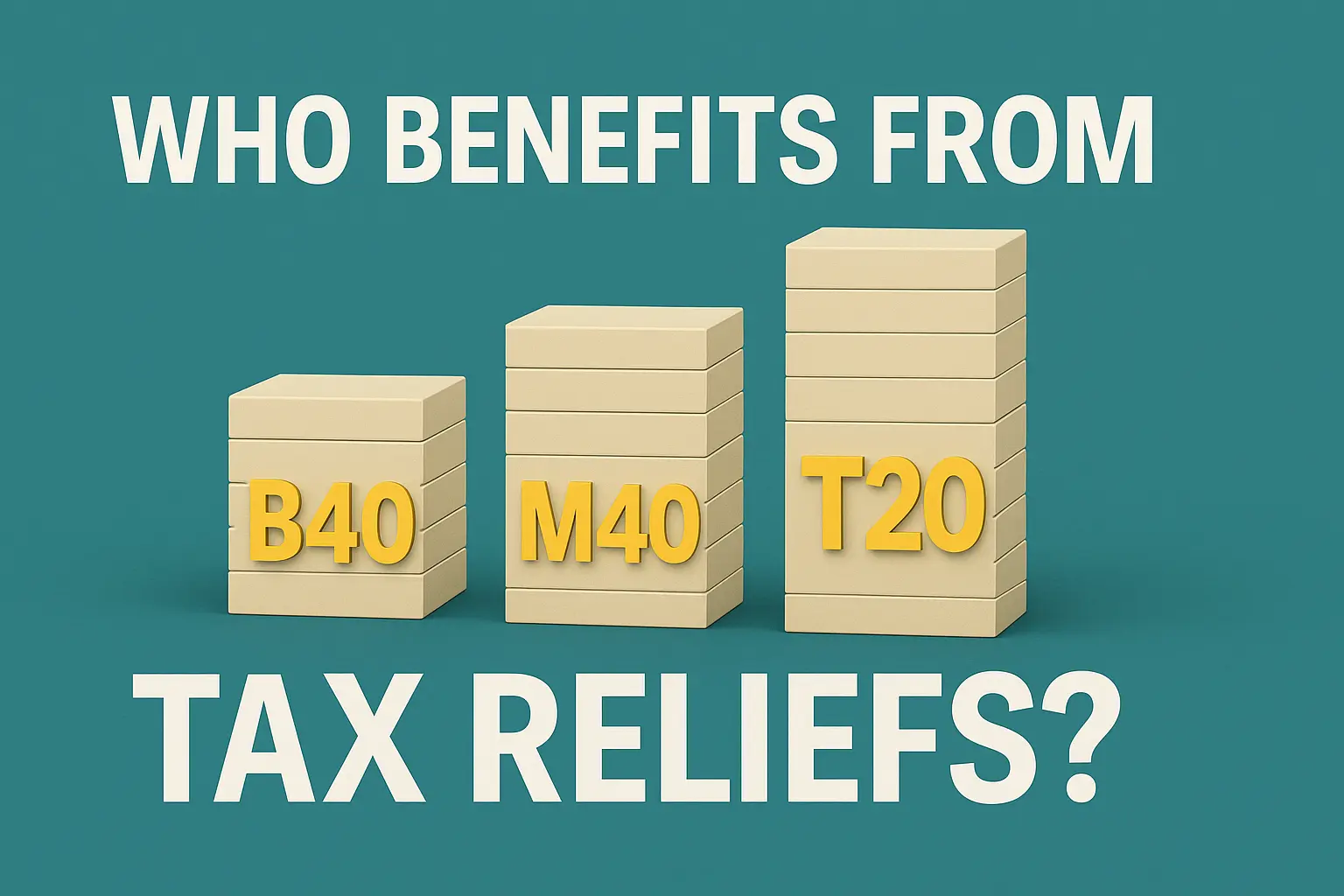

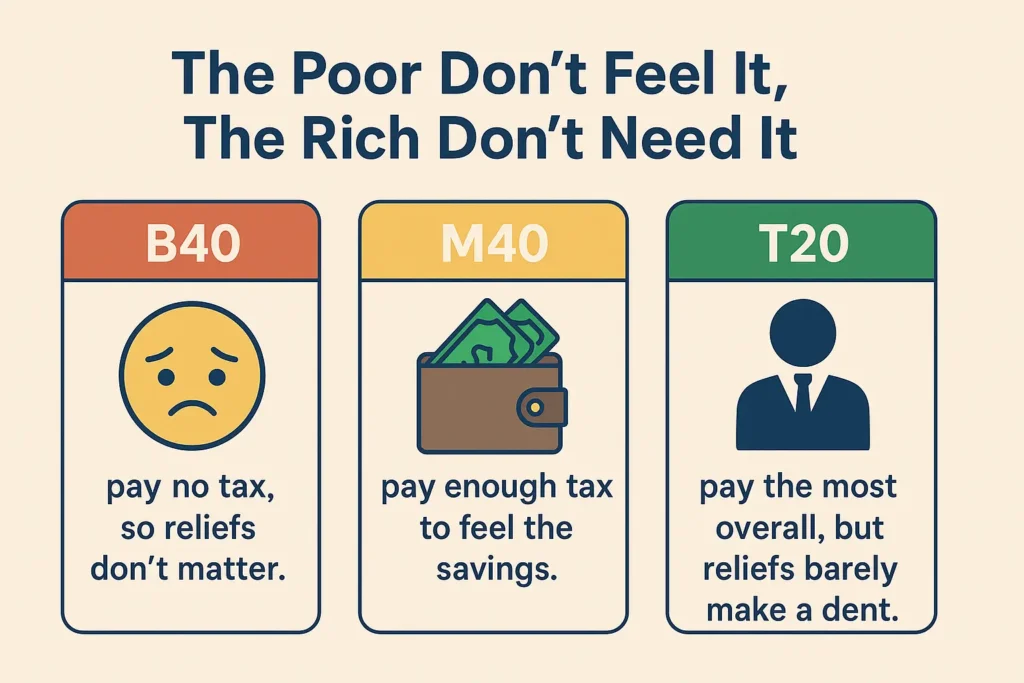

The Poor Don’t Feel It, The Rich Don’t Need It

Here’s the reality:

B40: pay no tax, so reliefs don’t matter.

M40: pay enough tax to feel the savings.

T20: pay the most overall, but reliefs barely make a dent.

For someone earning between RM4,000 and RM8,000 a month, those reliefs actually soften the blow of inflation and rising costs.

For others, they’re either irrelevant or negligible.

Malaysia vs Singapore: A Tale of Two Taxpayers

Now here’s a statistic that surprises almost everyone.

In Malaysia, only 12 percent of the population pays income tax.

In Singapore, about 30 percent do.

That gap isn’t because Singaporeans enjoy paying tax. It’s because more of them earn enough to be taxable.

Higher wages mean more contributors, more meaningful reliefs, and stronger public services.

In Malaysia, most workers still earn below the taxable line. On paper our reliefs look generous, but in reality most Malaysians never get to use them.

The Illusion of “Claiming Everything” (And Why You Should Still Track Receipts)

Many people think being smart with taxes means collecting every possible receipt. That’s not wrong, but it only works once you’re in a taxable bracket.

If you’re not yet paying tax, tracking receipts is still valuable. It builds the habit early.

When your income eventually grows, you’ll already have a clean record that makes claiming easy and accurate.

Instead of hoarding paper slips, start digitising them. Use an app to store and categorise your spending automatically so you can see which expenses are claimable and how much relief they add up to.

That’s not chasing receipts, that’s planning ahead for the day those receipts finally start saving you real money.

Why the M40 Deserve More Credit

The M40 often get forgotten in policy debates.

They earn too much for subsidies but not enough to feel comfortable.

Yet they are the backbone of Malaysia’s personal tax revenue.

While most people skip e-Filing entirely, the M40 quietly carry the system, funding the hospitals, roads, and schools the rest of the country uses.

And they’re also the group who actually benefit from reliefs the most.

A few thousand ringgit in deductible expenses can bring real breathing space to a household budget. They are the taxpayers who truly feel the system working for them.

Final Thoughts

When you start paying income tax, don’t be discouraged, be proud.

It means you’ve crossed Malaysia’s income median and your financial decisions now matter.

Tax reliefs aren’t tricks or punishments. They’re small acknowledgements for those who have moved up.

So track your receipts, stay organised, and claim responsibly.

Because once you earn enough to need reliefs, every ringgit you save is proof that your effort has paid off.

Tax reliefs don’t make you rich.

Being rich enough to need them, and smart enough to keep the records, is the real privilege.

If you’re serious about taking control of your money, start here:

How to Stop Being Broke in Malaysia: 9 Brutal Truths You’re Avoiding

and

The Malaysian Money Dilemma: Pay Down Loans or Build Wealth First?