You want to grow your money, but your PTPTN loan, credit card balance, or ASB loan is holding you back.

Every month you think: Should I pay off my debt first… or start investing?

This is one of the biggest money decisions Malaysians face today, and making the wrong move can cost you years of financial progress.

This 2025 guide breaks it down clearly, so you can stop guessing and start making smart, confident moves with your money.

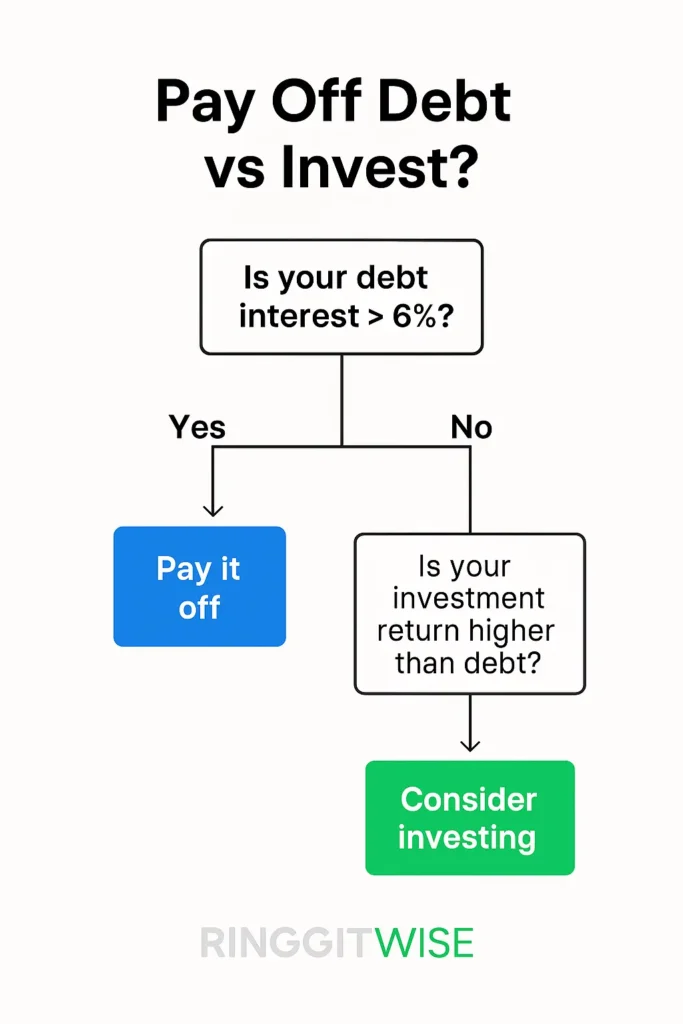

1. The Rule of Thumb: Compare Interest vs. Investment Return

A simple rule to decide:

- If your debt interest rate is higher than your expected investment return, pay off the debt first.

- If your debt is low-interest and your investment is likely to earn more, consider investing while paying minimums.

It’s all about opportunity cost, which one helps (or hurts) your net worth more?

2. When to Prioritise Paying Off Debt

High-interest debt is a silent killer.

Examples:

- Credit Cards: 15% – 18% p.a.

- Personal Loans: 8% – 12% p.a.

- BNPL (Buy Now Pay Later): May seem harmless, but missed payments stack up fees

If you’re paying 15% on debt and your investments return 6%, you’re losing money. Clear it first.

Tip: Always pay off credit card balances in full every month.

3. When It Might Make Sense to Invest First

Some debts are manageable or have low interest:

- PTPTN: 1% fixed p.a.

- ASB Loan: Around 4% – 5% p.a. (vs. ASB returns ~5.75% in 2024)

- Home Loans: 3.8% – 4.5% (can be lower if fixed)

If your investment options (e.g., ETFs, REITs, ASB, stocks) are returning more than your loan interest, you might be better off investing.

Just make sure:

- You’re never late with loan payments

- You have emergency savings (3–6 months)

- Your risk level suits your goals

4. Emotional vs. Mathematical Decisions

Even if the math says “invest,” some people sleep better knowing they’re debt-free.

Ask yourself:

- Will seeing a loan balance cause stress?

- Would clearing it early bring peace of mind?

- Are you disciplined enough to manage both?

Personal finance is personal. If being debt-free motivates you, it’s valid.

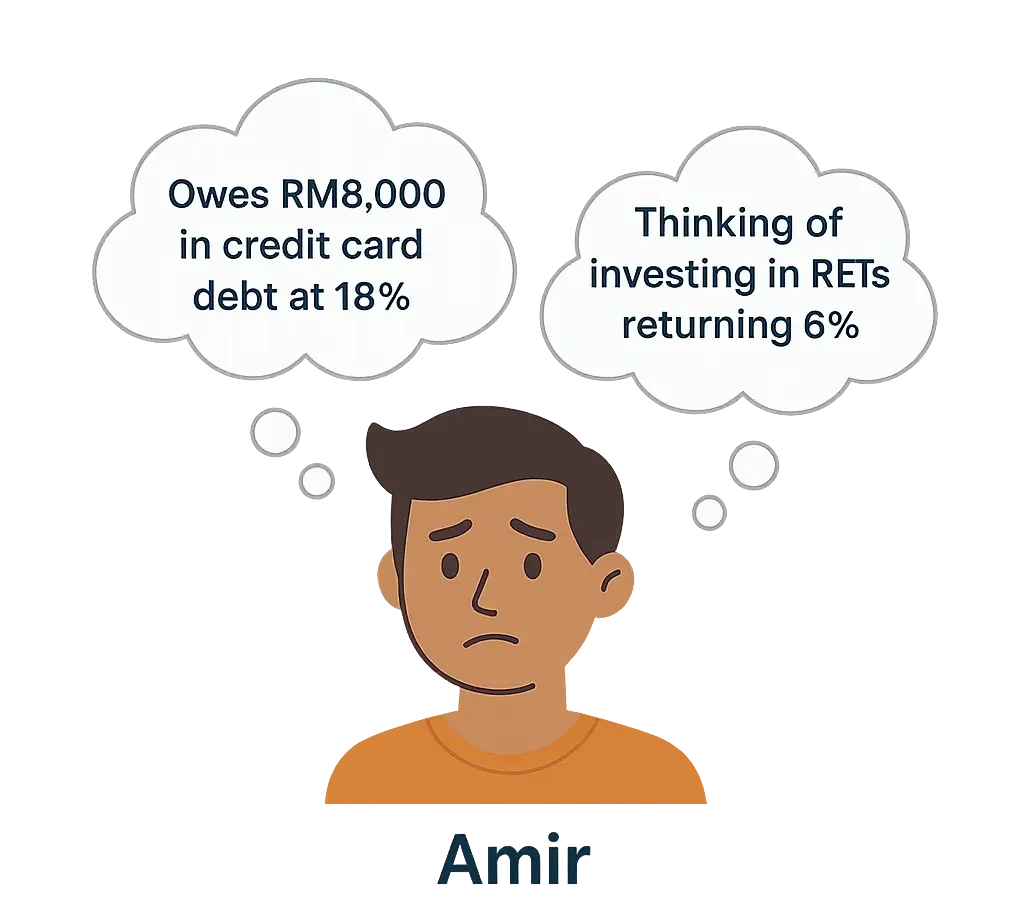

5. Malaysian Examples

Best move: Pay off debt first, then invest

Best move: Start investing while making minimum PTPTN payments

6. Final Checklist: Debt vs. Invest

| Situation | Recommendation |

|---|---|

| Credit card or personal loan >8% | Pay off first |

| PTPTN (1%), ASB loan (4%) | Okay to invest first |

| No emergency fund | Build savings before investing |

| Emotionally stressed by debt | Clear debt for peace of mind |

| Confident investor with low-interest debt | Consider growing your money |

Join thousands of Malaysians receiving expert advice on saving, investing, and financial planning every week.

Final Thoughts

There’s no one size fits all answer. But here’s the bottom line:

Paying off debt is like getting a guaranteed return. Investing is building future wealth. With a bit of planning, Malaysians can (and should) do both strategically.

Keep Learning

If you found this guide helpful, check out these next steps to grow your money:

How to Become Rich in Malaysia (2025): A Step-by-Step Guide to Building Wealth

Learn the mindset, strategies, and practical actions you can take today to build long-term wealth in Malaysia.

Most Malaysians Will Retire Broke — Why You Must Start Now (Free Checklist)

Understand the retirement crisis in Malaysia and how to take control of your future with our free financial checklist.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always speak to a licensed financial planner before making major financial decisions.

One thought on “Malaysian Money Dilemma: Pay Down Loans or Build Wealth First?”