Did you know you can earn rental income from Mid Valley Megamall or Pavilion KL, without owning a single shop lot? That’s the power of REITs (Real Estate Investment Trusts).

In 2025, REITs continue to be one of Malaysia’s most underrated investment tools. With dividend yields averaging 5% to 7% annually and minimal startup capital, REITs offer a passive income stream that’s accessible to everyday Malaysians.

This guide is designed for new and seasoned investors who want real estate exposure without the stress of property ownership. Whether you’re fresh out of uni or a retiree looking for steady cash flow, REITs deserve a serious look.

Meet Helmi, a 30-year-old engineer from Penang. He dreams of passive income but doesn’t have RM100k for a condo. So, he starts with just RM1,000 in REITs, earning quarterly dividends from malls, hospitals, and warehouses.

No hassle, just steady income.

1. What Are REITs?

Think of REITs as a way to own pieces of income-generating properties, like Pavilion KL, Mid Valley Megamall, or even hospitals, without buying the entire building.

A Real Estate Investment Trust (REIT) is a publicly listed trust that owns and manages commercial properties such as malls, warehouses, office buildings, hotels, and healthcare facilities. When you invest in a REIT, you’re buying units (similar to shares), and in return, you receive a portion of the rental income as dividends.

Why Malaysians Choose REITs:

- Start investing with as little as RM100

- Earn 5% to 7% annual dividend yields

- No need to manage tenants, repairs, or maintenance

- Fully tradable on Bursa Malaysia for liquidity

- Professionally managed portfolios with transparent reporting

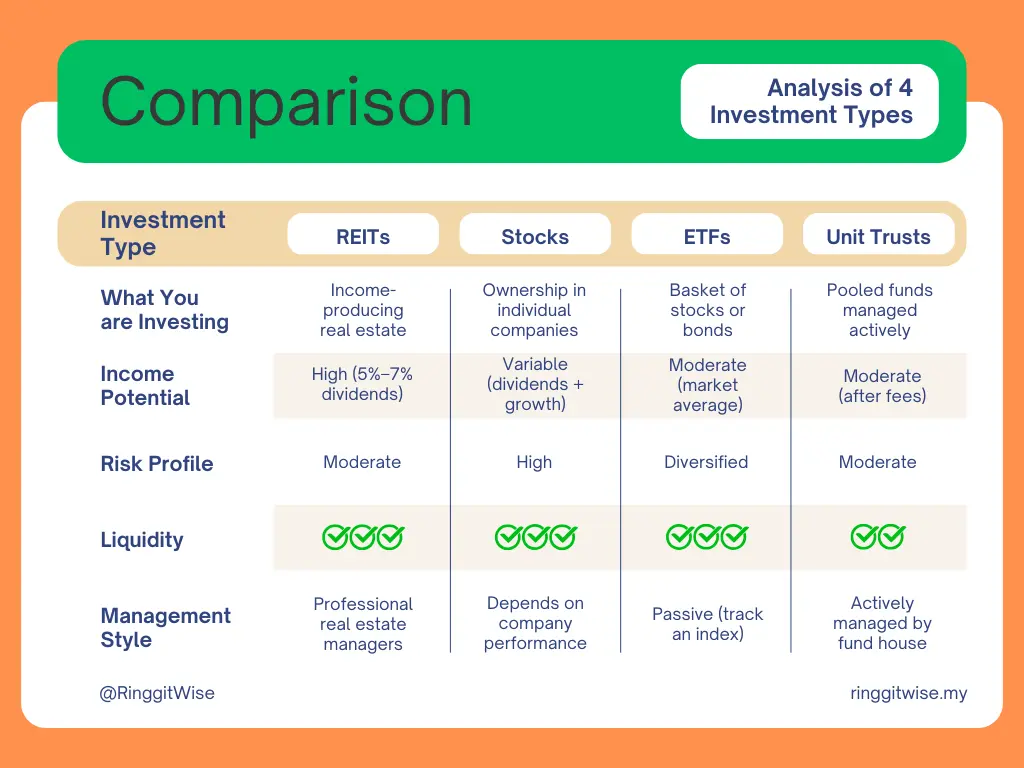

2. How Do REITs Compare to Stocks, ETFs, and Unit Trusts?

It’s easy to confuse REITs with other investments like stocks, ETFs, or unit trusts. Here’s how they differ:

Why REITs stand out:

- They provide tangible exposure to property markets.

- Offer higher consistent dividends compared to most ETFs or unit trusts.

- Less volatile than individual stocks.

- Managed by professional property managers with strict regulations under the Securities Commission Malaysia.

If your goal is passive income from real assets, REITs often outperform in that niche.

3. Best REITs in Malaysia (2025)

Here are some of the most reliable and well-performing Malaysian REITs in 2025, based on dividend yields, asset strength, and analyst outlooks:

| REIT Name | Dividend Yield | Sector | Why It Stands Out |

| Axis REIT (AXREIT) | 5.12% | Industrial | Strong logistics demand and consistent growth through acquisitions |

| Sunway REIT (SUNREIT) | 5.43% | Mixed/Retail | Exposure to malls, hotels, hospitals. Diversified and resilient |

| Pavilion REIT (PREIT) | 6.35% | Retail | Owns Pavilion KL & Pavilion Bukit Jalil. Premium retail exposure |

| IGB REIT (IGBREIT) | 4.69% | Retail | Includes Mid Valley & The Gardens. High occupancy and foot traffic |

| Al-Aqar Healthcare | 5.82% | Healthcare | Focus on hospitals and healthcare facilities. Steady, long-term demand |

| Sentral REIT | 8.21% | Office | High yield with established office assets and long-term tenants |

| AME REIT | 4.65% | Industrial | Expanding industrial asset base, positioned for long-term growth |

4. How Much Can You Earn?

Let’s take a practical example. Suppose Ali invests RM20,000 in Sunway REIT with a 5.43% dividend yield:

- RM20,000 x 5.43% = RM1,086/year

- That’s around RM271 every quarter, paid directly into his brokerage account

By reinvesting these dividends, Ali grows his portfolio steadily and earns more each year thanks to the power of compounding.

5. How to Start Investing in Malaysian REITs

Step 1: Open a CDS & Trading Account

You’ll need a Central Depository System (CDS) account to buy REITs listed on Bursa Malaysia. Open one with:

Step 2: Fund Your Account

Transfer funds into your trading account via online banking or FPX.

Step 3: Choose and Buy REITs

Search for REIT stocks by ticker symbols like AXREIT, IGBREIT, SUNREIT. Review their dividend history, property portfolio, and recent performance before investing.

Step 4: Collect Dividends

Most Malaysian REITs pay dividends quarterly or semi-annually. These will be credited to your account and can be withdrawn or reinvested.

6. What Are the Risks?

REITs are relatively stable, but like all investments, they carry some risk:

- Property Market Downturns can reduce rental income

- Interest Rate Hikes may affect REIT performance and investor sentiment

- Tenant Risk if major tenants vacate properties

- Economic Cycles especially impact retail and hospitality sectors

Tips to Reduce Risk:

- Diversify across sectors (e.g., retail, industrial, healthcare)

- Focus on REITs with strong tenant profiles and low vacancy rates

- Reinvest dividends for long-term growth

7. Taxation on REIT Dividends in Malaysia

REIT dividends in Malaysia are subject to a withholding tax of 10% for individual investors. This tax is usually deducted at source before the dividends are paid to your account.

This means if your REIT pays RM1,000 in gross dividends, you’ll receive RM900 after tax. Always consider net dividend yields (after tax) when comparing REITs.

Join thousands of Malaysians receiving expert advice on saving, investing, and financial planning every week.

8. REITs vs. Physical Property in Malaysia

| Factor | REITs | Physical Property |

| Capital Needed | RM100 and up | RM100,000+ (down payment, legal fees) |

| Liquidity | High. Sell anytime on Bursa | Low. Takes months to sell |

| Rental Income | Dividends paid quarterly | Direct rent (self-managed or agent) |

| Management | Fully passive | Requires active involvement |

| Control | No direct control | Full control over the asset |

REITs are ideal for those who value convenience, lower capital requirements, and passive income. Physical property may suit those who prefer direct control and are comfortable managing real estate.

9. Final Thoughts: Are REITs Worth It in 2025?

REITs offer Malaysians an accessible and effective way to generate passive income from real estate. With dividend yields between 4.6% to 8.2%, minimal capital requirements, and ease of trading, REITs are well-suited for both beginner and seasoned investors.

REITs are a good fit if you:

- Want regular dividend income

- Prefer low-maintenance investments

- Seek to diversify beyond stocks or unit trusts

- Aim to start small but grow steadily

Quick Recap:

- Top REITs: Axis, Pavilion, Sunway, IGB, Al-Aqar

- Expected Yields: 4.6% – 8.2% annually

- Start from RM100 with platforms like Rakuten or MIDF

- Reinvest dividends to compound your returns

Take control of your financial future by exploring REITs in 2025. It’s never too early or too late to build a reliable stream of passive income.

Also read: Most Malaysians Will Retire Broke — Why You Must Start Now Before It’s Too Late (Free Checklist)

Disclaimer: This article is for informational purposes only. Always do your own research or consult a licensed financial advisor before making investment decisions.

One thought on “REIT Malaysia 2025: How to Invest in Real Estate Without Owning Property”